By Henri Migala and Miriam Raftery

By Henri Migala and Miriam Raftery

Photo, left, by Henri Migala: around 200 residents attended a forum in La Mesa organized by Carl DeMaio of Reform California, which opposes the mileage tax

November 4, 2021 (San Diego’s East County) -- The San Diego Association of Governments (SANDAG) on Friday approved a controversial road usage tax, also known as a mileage tax. The measure drew strong opposition from East County residents and political leaders, who argue that its unfair to charge hefty taxes to inland residents who won’t benefit from ambitious transit projects planned in coastal areas.

SANDAG plans to release its final 2021 Regional Plan and Environmental Impact Report on November 30, with a vote to adopt both at SANDAG’s December 10 meeting.

SANDAG plans to release its final 2021 Regional Plan and Environmental Impact Report on November 30, with a vote to adopt both at SANDAG’s December 10 meeting.

The 4.3 cent per-mile tax, along with a two new half-cent regional sales taxes, are intended to help fund SANDAG’s $160 billion long-term regional plan that includes building out free public transit and a 200-mile regional rail network over 30 years, along with potentially some highway upgrades.

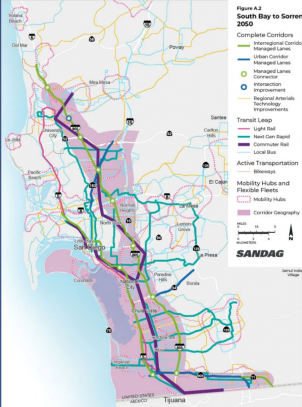

But a map of those transit projects reveals that none of the projects are planned in East County’s rural, mountain or desert communities – areas where residents are reliant upon driving their own vehicles to work, school, medical appointments and other essential destinations. Much of the inland region is not even shown on SANDAG’s map.

The plan does call for some freeway improvements including an interchange at I-8 in Alpine near Willows Road and managed lanes along part of I-8 through east El Cajon. But to many residents, it’s not enough. Santee residents have long complained of a bait-and-switch after being promised widening of State Route 52 in exchange for approving major housing development, but instead, gridlock has worsened and SANDAG now indicates widening freeways is not a priority.

Supervisor Jim Desmond, whose district includes remote desert and mountain communities, has stated, “This proposal should never see the light of day. San Diegans already pay some of the highest prices to drive in the country. From the current gas taxes to a vehicle registration tax, San Diegans feel the effects in their wallets every day.”

Supervisor Jim Desmond, whose district includes remote desert and mountain communities, has stated, “This proposal should never see the light of day. San Diegans already pay some of the highest prices to drive in the country. From the current gas taxes to a vehicle registration tax, San Diegans feel the effects in their wallets every day.”

Desmond told ECM that while voters will have the final say on a proposed sales tax increase via ballot initiative countywide, he does not expect that to include the mileage tax, which SANDAG can impose unilaterally.

Supervisor Joel Anderson, who does serve on SANDAG and represents much of East County, stated in a letter to SANDAG’s CEO Hasan Ikhrata, “A significant number of my constituents also represent the `toolbelt’ workforce who need their vehicles to perform work.” He says the tax would unfairly impact many in his district who have no alternative to driving.

Mayor Bill Wells, El Cajon’s representative on the SANDAG Board of Directors has issued the following statement: “I adamantly oppose the so-called driving tax on San Diego’s working families. It is terribly unfair, especially since San Diego drivers already pay an exorbitant gasoline tax. It’s obvious that SANDAG is desperately trying to bolster non-existent ridership on buses and trolleys while once again sticking it to those who drive cars, which is basically everyone.”

Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week, drawing a crowd of 200 residents. In an interview with East County Magazine,

“It’s going to kill working families,” complained DeMaio. “A mileage tax and a sales tax are a regressive tax. People at the lower end of the earning pyramid will end up having a bigger impact than those at the very top. Especially rural and people in the service industry. If you have someone who cleans homes, or is a gardener, they’re going to see a major impact. Anyone in the construction business, a plumber, or electrician, anyone having to do a lot of driving around, they’re going to get a major impact from this. The mileage tax and the sales tax is like a ‘double whammy’ hit to working families.”

“It’s going to kill working families,” complained DeMaio. “A mileage tax and a sales tax are a regressive tax. People at the lower end of the earning pyramid will end up having a bigger impact than those at the very top. Especially rural and people in the service industry. If you have someone who cleans homes, or is a gardener, they’re going to see a major impact. Anyone in the construction business, a plumber, or electrician, anyone having to do a lot of driving around, they’re going to get a major impact from this. The mileage tax and the sales tax is like a ‘double whammy’ hit to working families.”

DeMaio recognized that opposing the mileage tax and the sales tax would be a difficult challenge because of the funding available to promote those initiatives. But he was confident, stating that “We have a winning record on all local tax increases we opposed. When we say we’re going to oppose this tax increase, and we fund a campaign, we’ve been able to win those races, locally, since 2004.”

DeMaio says he opposes this and other tax increases “because you already have the highest income tax, the highest sales tax, the highest gas tax, the highest car tax, some of the highest property taxes. So, what more are you trying to squeeze out of these working families. We have the highest water rates, the highest electricity rates. Our cost of living here in San Diego County now is about 41% higher than the national average,” he continued. “That mean, for whatever anyone else can live on for $1,000 anywhere else in the country, we have to earn $1,410. That’s $5 grand a year. That’s what we’re talking about here.”

Checking DeMaio’s statements about the high cost of living in California, California does have the highest income tax rate in the nation, at 13.3%, followed by Hawaii (11%), New Jersey (10.75%) and Oregon (9.9%).

California also pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg), according to the Tax Foundation.

And according to the World Population Review, the state with the highest car sales tax is California (7.25%), followed by Tennessee, Indiana, and Rhode Island (7%).

Comparing water rates is difficult, for a variety of reasons, but the best data available comes from Circle of Blue, which surveyed the 30 largest cities in the nation and found that Santa Fe had the highest rates. https://www.circleofblue.org/2010/world/the-price-of-water-a-comparison-of-water-rates-usage-in-30-u-s-cities/

According to the Nebraska Department of Environment and Energy, which conducted a state-by-state comparison of electricity rates found that Hawaii has the electricity rate in the country, at 28.72 cents per kilowatt hour. https://neo.ne.gov/programs/stats/inf/204.htm

According to SDGE electricity rates in San Diego range from 27 to 31 cents per kilowatt hour. https://www.sdgenews.com/article/new-electric-rates-effect

According to the Tax Foundation (www.taxfoundation.org) the five states with the highest average combined state and local sales tax rates are Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent). The sales tax rate in San Diego County is currently 7.75%.

SANDAG is governed by a Board of Directors composed of mayors, councilmembers, and county supervisors from each of the region's 19 local governments. Supplementing these voting members are advisory representatives from Imperial County, the U.S. Department of Defense, Caltrans, San Diego Unified Port District, Metropolitan Transit System, North County Transit District, San Diego County Water Authority, Southern California Tribal Chairmen's Association, Mexico, and the San Diego County Regional Airport Authority.

Although SANDAG’s Board representation is extensive, it does not include representation from most of the county’s mountains, deserts, and vast rural areas, where residents who will be the most disproportionately affected by the mileage tax live. Jim Desmond, the Supervisor for that region, was recently replaced on the SANDAG board. Yet these rural and outlying areas have some of the lowest income rates of the county, with high rural poverty pockets.

Rural residents contend that it is fundamentally unjust to burden rural residents with a disproportionate amount of the mileage tax, especially since they have no representation on the SANDAG Board. Taxation without representation is viewed as a fundamental American principal – the same principal that led colonists to stage the Boston Tea Party, precursor to the American Revolution to win independence from Great Britain.

On social media, residents railed over the mileage tax, almost universally opposed.

A mother wrote, “We’re being punished for driving our cars to our jobs, our kids to schools, errands we must run, etc. We have to fight back.”

“SANDAG has the nerve. So many of our roads have not even been done and they want to add MORE taxes to us that are barely even getting by paycheck to pay check???” one man posted on Next Door.

A woman posted, “So you are in favor of penalizing poor people that have to drive to get to work. If you live 45 minutes away it would take you 3 hours to get there on public transportation.”

Others voiced concern over needing to drive vehicles long distances for work, such as people who work hauling equipment in trailers or dump trucks.

Lemon Grove Councilman Jerry Jones objects to drivers of electric cars using roadways for free, since they don’t use gas or pay gas taxes meant to pay for roads, freeways and transit.

Lemon Grove Councilman Jerry Jones objects to drivers of electric cars using roadways for free, since they don’t use gas or pay gas taxes meant to pay for roads, freeways and transit.

He also voices concern that while a gas tax is a pay-as-you-go method that assures people won’t spend more than they can afford, “how many of us could make a one-time lump sum payment of near $1,000 to the state…it’s going to be about restricting your travel by making your car (electric or legacy) too expensive to drive, without providing adequate options….Even for free, this transit plan does not serve the region for its transportation needs…Yes the San Diego region needs transit, but it also needs a balanced system that includes transit, freeways, and local roads. Don’t ask the 87% to pay for the free transit system of the 13%.”

The fact that the plan favors the city of San Diego over most other areas is no accident. A state legislative proposal by Assemblywoman Lorena Gonzalez enacted in 2017 changed SANDAG’s voting method to weaken the influence of most cities. Now the vote is weighted based on population, so the cities of San Diego and Chula Vista control 60% of the vote – and regularly cast votes that ignore the needs and voices of East County’s residents.

Jones’ notes that the city of San Diego’s political leaders “will call the shots at least until it goes to the ballot box. Don’t forget,” he urges residents.

Not everyone is opposed. The rationale for the tax is that the state’s funding for roadwork and transit has diminished sharply, since more people are driving electric cars, hybrids or fuel-efficient vehicles. Using less gas means reduced gas tax revenues for California. The plan has support of some coastal community representatives in North County, for example.

It’s unclear just how the per-mile rate would be determined, but likely it would rely on reporting by the DMV whenever people reregister their vehicles and report mileage. Possibly car repair or smog check sites could be mandated to report mileage.

Read more about SANDAG’s regional plan at www.SDForward.com.

This article has been updated Nov. 4 with comment from Supervisor Desmond clarifying that the ballot initiative will include only the sales tax increase, not the mileage tax, which SANDAG has final authority to approve.

Comments

Carl DeMaio is right, but...

still waiting

DeMaio is an uneducated