Update Nov. 15, 2022: A federal appeals court has blocked the student loan forgiveness plan. The Biden Administration is likely to appeal the decision.

Update Nov. 15, 2022: A federal appeals court has blocked the student loan forgiveness plan. The Biden Administration is likely to appeal the decision.

By Miriam Raftery

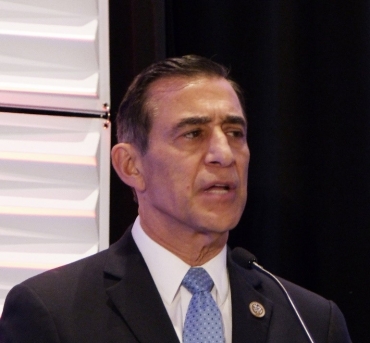

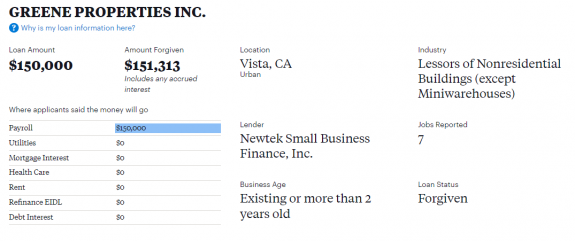

October 7, 2022 (San Diego) – Congressman Darrell Issa has been sharply critical of President Joe Biden for cancelling a small percentage (10-20%) of student loan debts. But Greene Properties in Vista, for which Issa is listed as Chief Executive Officer (CEO), pocketed $151,313 in federal loan forgiveness on a Paycheck Protection Plan (PPP) loan during the COVID-19 pandemic. The company’s website had since gone dark, offline for at least the past several weeks.

According to PPP loan forgiveness data tracked by ProPublica, Green Properties had $151, 313 (the original $150,000 loan plus interest) forgiven on April 8, 2021 after the applicant promised to use the funds originally loaned in May 2020 for payroll.

Issa’s financial disclosure report with the House of Representatives, filed on July 7, 2021 (three months after the PPP loan was forgiven) still lists him as Director of Greene Properties.

As of 2020, the year Greene Properties got its COVID PPP loan, Business Insider listed Rep. Issa as the third richest man in Congress, with a minimum estimated net worth of over $115 million.

The company was founded in 1997 by Issa’s wife, Katherine as a joint trust. The couple divorced last year. The California Secretary of State at https://bizfileonline.sos.ca.gov/search/business lists Greene Properties under entity number C2057614, first incorporated in 1997 by Katherine Issa (document 25789793-1), and show a Statement of Information filed in 2011 listing Darrell Issa as the CEO and Katherine as the Secretary (document 25789800-1) and a subsequent Statement of Information from 2021 stating that "there has been no change in any of the information contained in the previous complete Statement of Information filed with the California Secretary of State." (Document 25789801-1). There are no further amendments or statements filed with the CA Secretary of State.

Greene Properties’ website has been non-functioning for at least the past several weeks, and it is unclear whether the company is still operational or whether the PPP loan funds forgiven actually were used to pay employees.

Yet Issa has railed against far smaller amounts being forgiven for Americans struggling with student debts. Biden forgave 10% of federal loans for those earning $125,000 a year or less and 20% for low-income Pell grant recipients, with nothing for richer loan recipients.

On Twitter, Issa accused Biden of using student loan debt cancellations to entice voters.

In an interview on KUSI, Issa further blasted forgiving student loan debts, noting that people who didn’t attend college will now be helping to pay off loans for those who did, KUSI posted on Facebook.

Issa announced his support for extending PPP loans for businesses in March 2021, just weeks before the company he headed got a six-figure PPP loan forgiveness. But he voted against some other COVID relief.

His opponent, Stephen Houlahan, told ECM, ““I find it hypocritical that Rep. Darrell Issa, one of the richest members of Congress, took a $150,000.00 PPP payment, then voted against providing a fraction of that amount, $1,400.00 to his constituents during the second round of COVID-19 relief!”

ECM reached out to Rep. Issa with questions on Greene Properties and the PPP loan forgiven for the business, but as of press deadline, he has not responded.

Comments

The two are not comparable

Really?

You are compairing 100K any business could apply for to billions in student loan bailouts? I will never understand the mind of a Socialist.

ya issa

What is hypocritical is the accusation

just more prof

PPP was a Grant, not a loan